If you rent your car out as a private person, then the amounts transferred by Autolevi act as an income for renting out your car. It is precisely the same income that you would earn from renting your apartment or house. Autolevi cannot declare the earned income for use and does not communicate with the Tax Board in order to organise it for you.

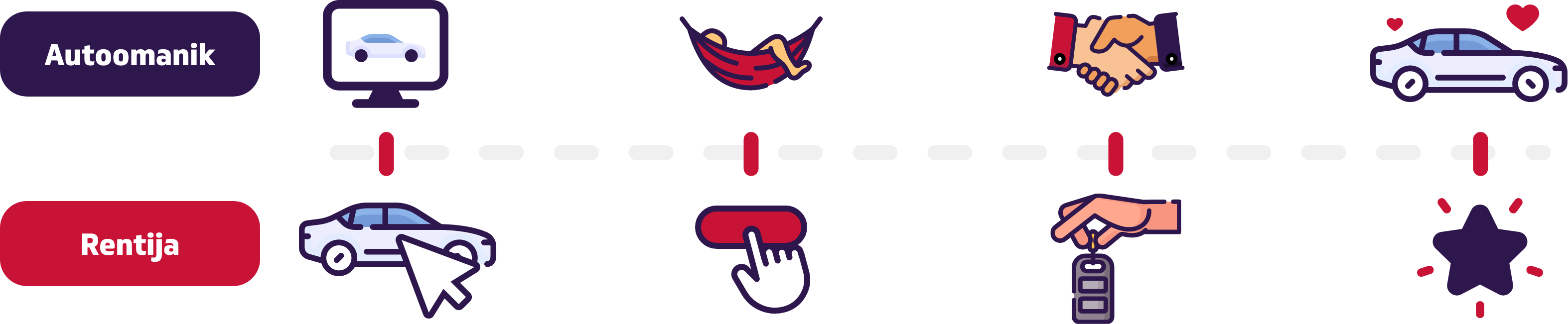

How it works?

1. Add your car to Autolevi.

2. Wait until you get reservation.

3. Meet with renter and hand over your car.

4. Receive car from renter. Give feedback.